APR Explained

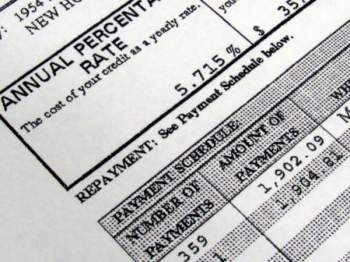

The abbreviation APR, in terms of finance, refers to an annual percentage rate. The annual percentage rate is the interests that is being charged or implemented on a particular loan. Typically speaking, an APR will usually be included in most large loans, such as in a mortgage home loan and even for motor vehicle loans.

An annual percentage rate will prove to be a very important facet in regards to loans, for they will ultimately affect the final amount that is to be paid by the debtor of the loan. Furthermore, APR rates will prove to differ in terms of the nature of the loan and even location.

Typically speaking, an annual percentage rate is implemented in order to cover certain costs as well as interests. Some of the other costs included in APR may be loan fees, closing costs, application fees, and the actual cost of the loan itself.

Another important aspect to consider in regards to an annual percentage rate is how it is applied in terms of payments. In many cases, in the initial life of certain loans, the first payments will usually be applied toward the interest rather than the principal amount. As more payments are made, more of the payment will be applied toward the principal balance. This is why being aware as to how an annual percentage rate is to be included in a loan is important. In some instances, high interest amounts in the beginning of a loan will oftentimes also be included in the APR.